Alibaba is a big data-centric conglomerate, with transaction data from its marketplaces, financial services, and logistics businesses. Big data has also allowed the company to move into cloud computing, media/entertainment, and online-to-offline services. The strong network effect and big data obsession enable the leading E-commerce platform player in China to extend into many other growth avenues.

Alibaba’s internet services affect a staggering vast majority of Chinese internet users, an 83 % penetration rate for the Taobao/Tmall E-commerce marketplaces by the end of 2019. This provides Alibaba with an unparalleled source of data that it can use to help merchants and consumer brands develop personalized mobile marketing and content strategies to expand their target audience.

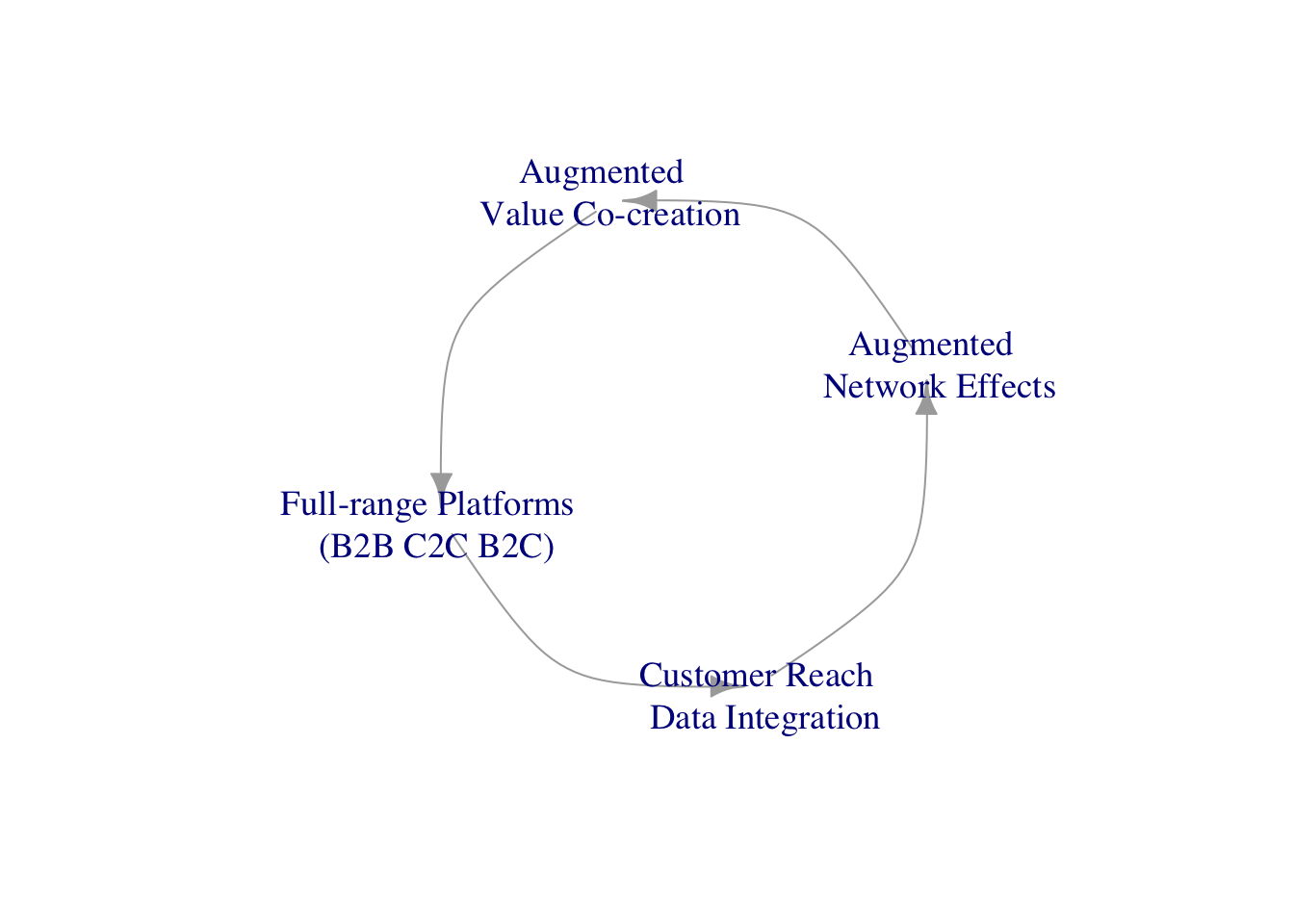

Alibaba benefits from a strong “two-sided” network effect. The value of the platform to consumers increases with a greater number of sellers, and vice versa. Millions of Chinese consumers consider Taobao and Tmall as their default go-to options when seeking products and services online. Taobao users with a strong appetite for branded products can shop Tmall for a better shopping experience, and assurance of higher quality, whereas Taobao’s online marketplaces are interconnected, which compounds its network effect then breeds other competitive advantages and growth opportunities. Taobao and Tmall have developed a powerful brand as Alibaba’s core intangible assets.

The decision to consolidate Cainiao and invest more heavily in new smart warehousing and other logistics technologies will shift Alibababa away from a pure virtual platform. The enhanced logistics capabilities stemming from its partnership with other retailers strengthen this platform’s network effect and make it more compelling for buyers and sellers.

Alibaba has had limited success with its previous e-commerce endeavors outside China. The acquisition of NetEase’s cross-border online commerce platform Kaola is considered complementary to Tmall Global. Global merchants have enjoyed a low cost and flexibility on the Alibaba’s global purchase platform, which has helped Alibaba maintain and accelerate their market share in import and outport services.

Alibaba’s desktop and mobile monetization rates have been on upward trends. The company has also increased its investments in user experience as other local and global players look to expand its presence in China. Alibaba has increased its monetization rates overtime via improved seller conversion rates from personalized the embracing of data-enriched marketing tools by mobile sellers, and increased contribution from Tmall.

Alibaba Cloud is likely to develop into a growth engine and a significant cash flow contributor overtime for the company. The early mover advantages in big data and cloud computing in China gives the company distinct advantages. Increased demand from corporations and other government groups look to reduce information technology expenditures.