Apple has plenty of opportunities to reap the rewards of its iPhone business. Apple’s iPhone and IOS operating systems have consistently been rated at the head of the pack in terms of customer loyalty, engagement, and security, which bodes well for long-term customer retention. Apple pay, Apple Watch, Apple TV, and Airpods are also driving incremental revenue and helping to retain iPhone users over time.

Apple’s walled garden approach for its popular iOS allows it to charge a premium for relatively commoditized hardware not too different from that sold by companies like Samsung, and Dell. Customer switching costs are elevated for Apple users as a non-apple IOS experience does not exist. Unlike computing platforms for the windows or android ecosystems that boast PCs and smartphones, Apple enjoys stellar returns on its devices by offering unique user experiences with its iOS ecosystem.

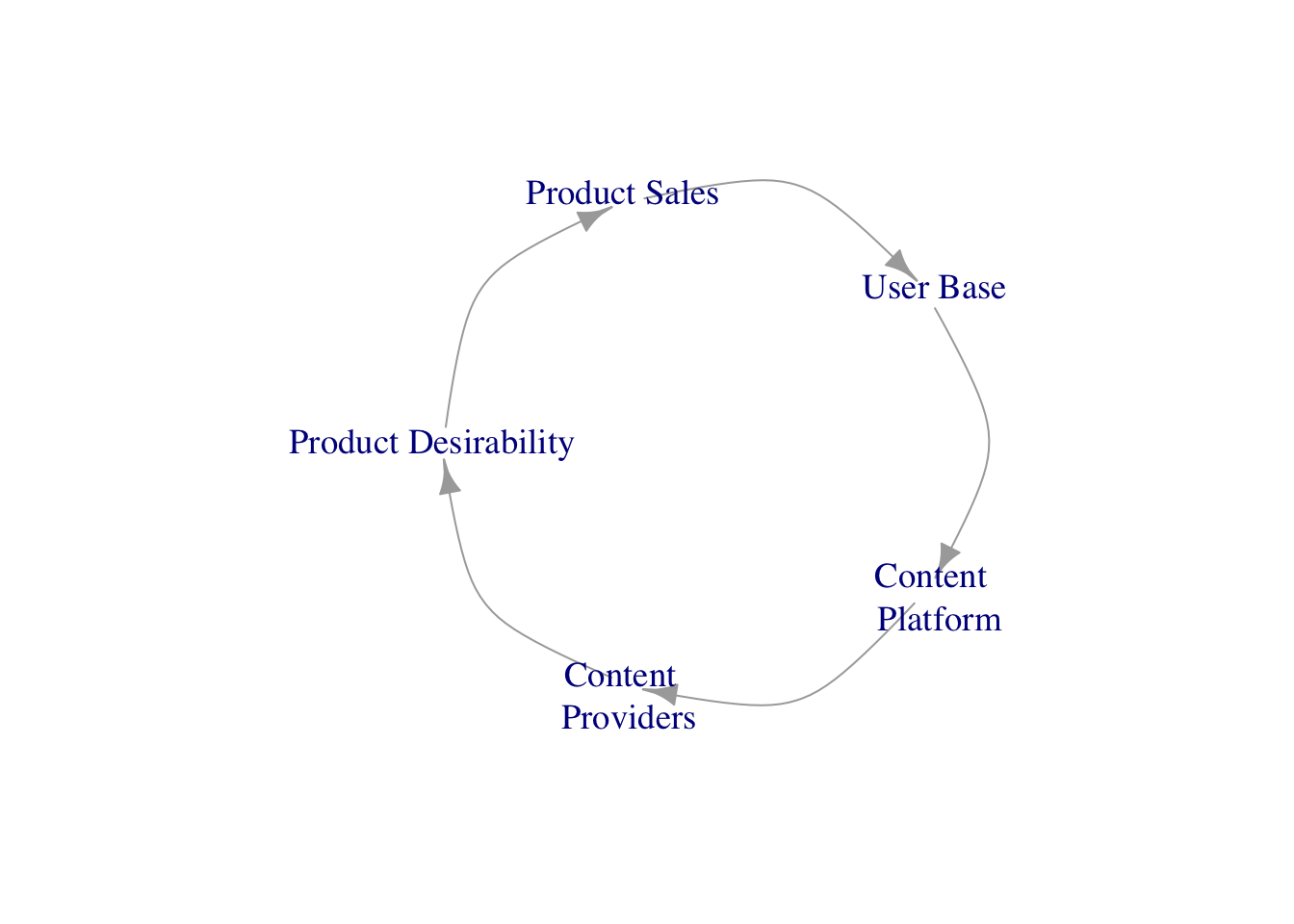

The robust App store helped foster iPhone adoption and grew Apple’s user base, with applications ranging from productivity, social media, gaming, and so on. Apple has also been focusing on newer software and services to augment the user experience and retain customers. For Apple’s customers, few other technology titans are offering comparable expertise in both hardware and software design, which allows the firm to more seamlessly build integrated products.

Competitors such as Samsung and Google specialize in hardware and software, respectively. But neither Samsung nor Google has been able to offer a comprehensive and integrated product like the iPhone. Both have attempted to develop software or operating systems (Samsung’s Tizen OS) and hardware (Google’s Pixel smartphone). Nonetheless, Apple’s expertise in both hardware and software represents an intangible asset that even the strongest of tech firms have struggled to replicate.

The active base of apple devices reached 1.5 billion at the end of 2019, up from 1. 4 billion a year prior, showing the strong stickiness Apple has created. These switching costs are not insurmountable, illustrated by the rise and fall of former mobile device titans such as Nokia, Motorola, and Blackberry. Apple may not be immune to pitfalls, as consumer sentiment for technology gadgets can be unforgiving, with one buggy or subpar product potentially driving customers to other companies.

Apple’s integration of hardware and software also supports its developer networks. Apple iOS will be loaded on to only a handful of screen sizes or iPhone models, versus the hundreds of devices and manufacturers that support android. This leads to a more fragmented Android ecosystem, which is relatively harder for developers to support. Some competitors are willing to sell hardware at essentially cost to drive revenue or stickiness in other business segments. A recent focus on AI assistants such as Google Now and Amazon Alexa has also put pressure on apple’s Siri that has fallen behind its peers in efficacy. Herein lies another area Apple may face headwinds if consumers further prioritize voice-recognition capabilities. Apple’s device may be at risk as it is not likely to supersede their iOS counterparts.