1. Backgroud

Ray Dalio at Bridgewater Associates has provided a model (in narratives in his book and an animation video), which illustrates how the macro-economy and the banking system work in a mechanical way like a machine. I converted the model into a system map. Bridgewater’s performance and track record have proved the quality of his decision making, which allows him to be consistently correct in betting on what happens next in the economy.

2. Mapping the Micro-economic ‘Machine’

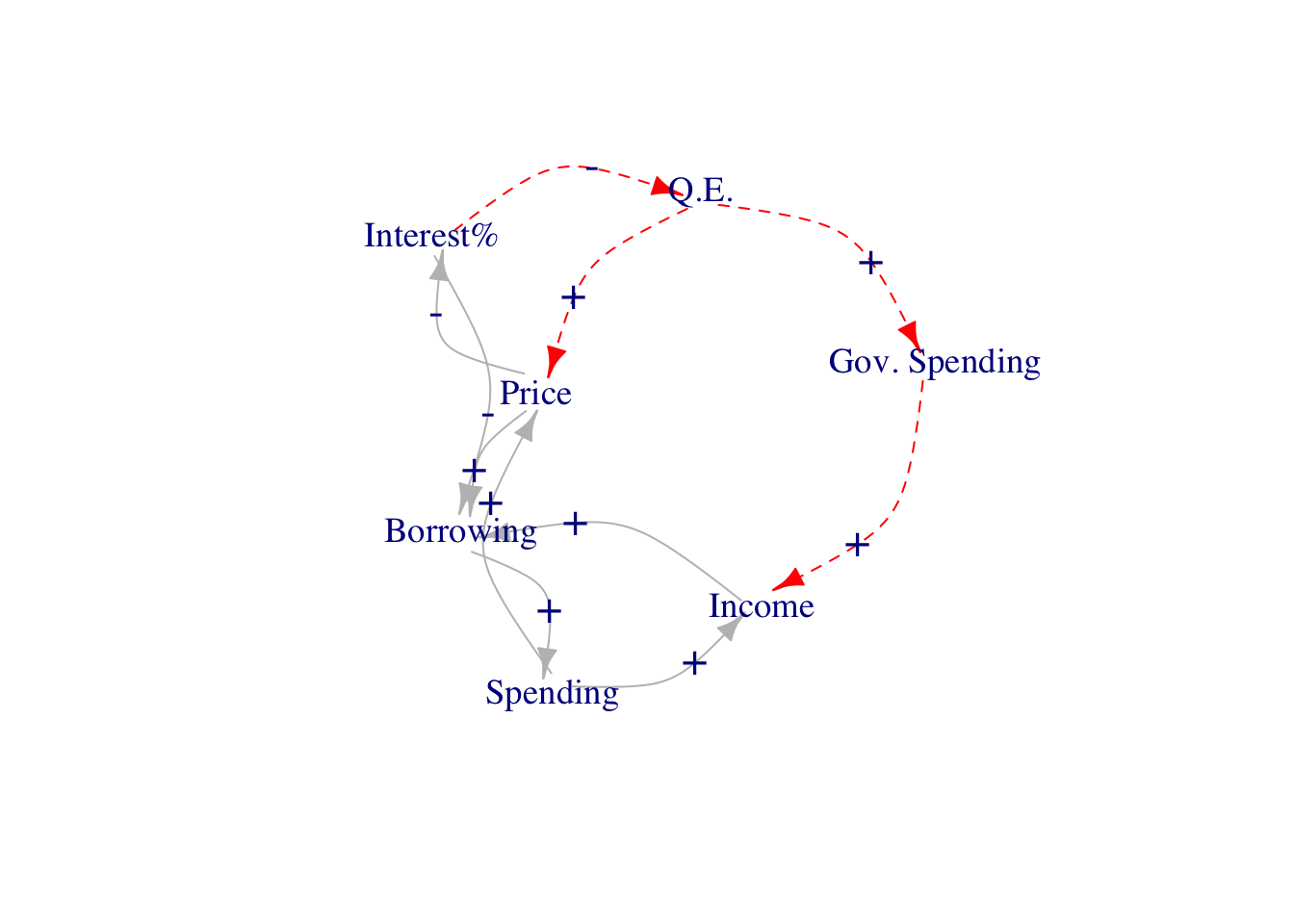

In this system, there are two essential components, the short-term debt cycle (the solid grey lines) and the long-term debt cycle (the red dotted lines). Debt creates money. Borrowing creates cycles. We enjoy economic growth until the system creates more credit than the real income-generating produtivity.

When interest rate hits zero, and the central bank can no longer stimulate the economy with a lower interest rate, we come to the end of the long-term debt cycle and enter into the stage of deleveraging and reflation (a.k.a. “the lost decade”). Next, we will wait and see if the government can execute a beautiful deleveraging (by controlling the rate of money-printing relative to the growth of debt).