Netflix has continued to burn billions of dollars of cash to create its original content with no end in sight. The need for increased content and marketing spend outside of the U.S. will limit the rate of margin expansion for the international segment. However, the volume of sales of the company has continued to grow over the past years.

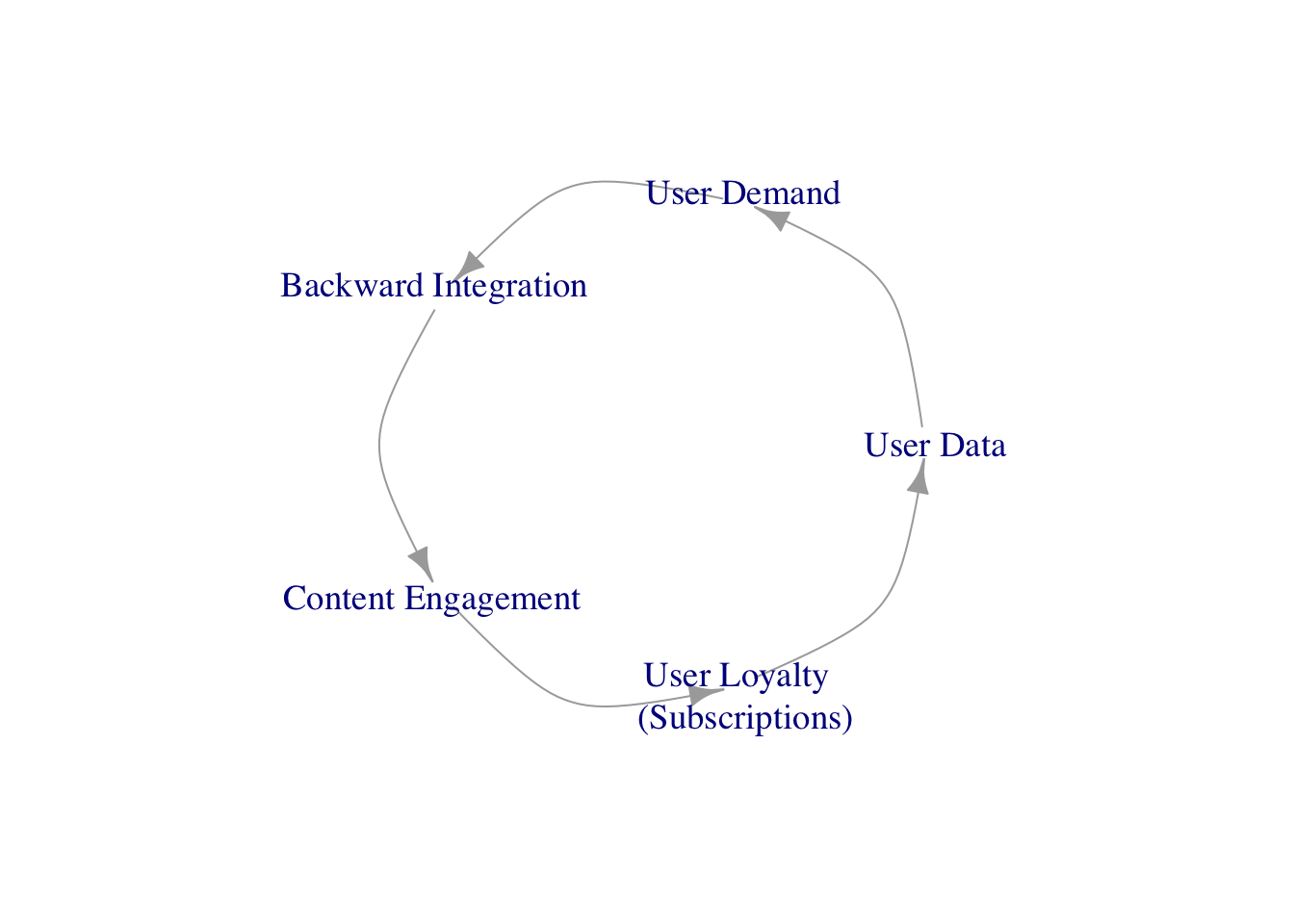

Netflix has used its scale to construct a massive data set that tracks every customer interaction. The firm then leverages this customer data to better purchase content as well as finance and produce original material. Netflix has expanded rapidly into markets abroad as the service has more subscribers outside of the U.S.

Media firms will continue to reap the benefits of both an additional window for existing content and another platform for new content. Larger firms like Disney and WarnerMedia have or will soon launch their own SVOD platforms to compete against Netflix. Such a usage pattern may constrain Netflix’s ability to raise prices without inducing greater churn. Netflix has also expanded further into local-language programming to offset the weakness of its skinny offering in many countries.

New content not only strengthens the relationship with current customers but also attracts new customers via word of mouth and the halo effect from critical acclaim and award nominations. The rapidly growing subscriber base (over 130 million worldwide) creates a humongous data set that Netflix mines to better purchase and create content. Netflix tracks every customer interaction, from large (total time spent at Netflix) to minute (whether a user pressed fast forward). By the end of 2019, Netflix accounted for 26% of all global video streaming traffic, beating out YouTube at 21% and amazon at 6%. The average Netflix user worldwide watches more than 90 minutes of video per day. Netflix can search for this information to better understand the network and device performance, customer behavior, and content popularity.

Netflix analyzes data traffic, video performance, and buffering to better understand where data loss and slowdown occurs. The company also examines specific subscriber actions by type of action and device used to formulate a better user interface and to tweak device-specific applications. The real-time nature of the data provides Netflix with the ability to iterate more quickly than traditional user groups or beta testing methods. A large number of subscribers using different devices across multiple countries generate an extensive, growing, robust data set.

The content discovery engine provides recommendations based on a subscriber’s previous viewing habits in context with similar viewing habits. While growing rapidly as a streaming video provider, the company understood the need to create original content to distinguish its offering. An often-cited example of this data is “House of Cards,” an adaption of a British miniseries starring Kevin Spacey. Netflix noted that the director David Flincher’s movies were generally watched from beginning to end, that Spacey’s films had performed well, and that the original version was popular with subscribers.

As Netflix is now available in almost every country, this cost could explode, particularly as new competitors like Disney enter the market and ramp up their content spending. The cost of licensing content will also rise as competitors emerge and bid for content that Netflix desires. The move to more original content adds costs and risks. Netflix ’s expansion outside the U.S. could continue to drag on cash flow due to different tastes and lower video consumption. The cost to deliver content could increase, and the need to pay for fast-lane network access could drag on margins. However, increasing price rates could limit growth and increase subscriber churn.