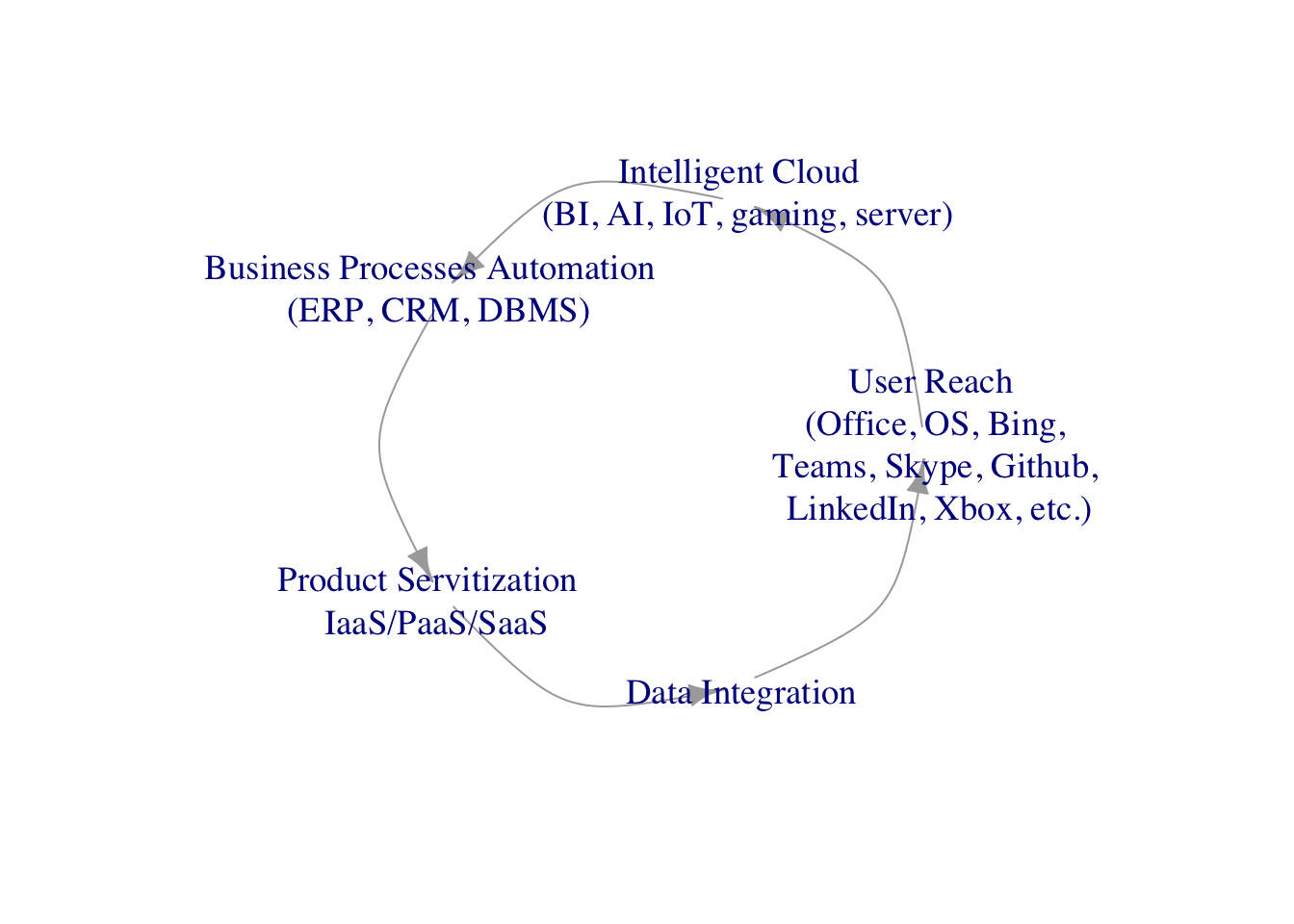

The shift to subscriptions accelerates growth after the initial growth pressure. The centerpiece of the new Microsoft grew at a staggering 92 % rate in fiscal 2018. It offers customers a painless way to experiment and move select workloads to the cloud. Microsoft can also leverage its massive installed base of all Microsoft solutions as a touchpoint for a strategic move. Microsoft continues to launch new services centered around these broad themes, as it continues to launch new services centers around these broad themes. Microsoft is an excellent launching point for secular trends in A.I., business intelligence, and the internet of things.

Office 365 (the cloud-based version of the traditional perpetual license Microsoft office) retained in office productivity software, which will remain steady in the foreseeable future. Customers will continue to drive the transition from on-premises to cloud solutions, and revenue growth will remain robust. The initial move to the cloud was painful, as both revenue and margins dropped. However, Microsoft’s revenue has accelerated, thanks to the cloud transition.

An office productivity suite generally consists of spreadsheet and presentation software applications. Microsoft offers a variety of versions of the office 365 suite and increasingly fewer perpetual license versions. Office 365 starts at approximately $6 per month and tops out at roughly $35 per user per month. The perpetual license version is $150. Office 365 already has more than 165 million subscribers.

Microsoft has continued to enjoy a dominant market share position in office suites, with Google being the only other vendor of consequence. Many users are willing to pay a minimum of $70 per year to use office 365 when free versions that are generally similar in terms of features and interface are available. Microsoft office benefits from high switching costs. Because of the significant installed base, it would be highly disruptive for a company to pivot to an office suite other than office 365. For example, reports within the financial function of countless enterprise users are pulled from an oracle, or other popular databases into an excel file that can then be manipulated.

Microsoft Dynamics is a cloud-based enterprise resource planning (ERP) and customer relationship management (CRM) suite of applications designed to help mid-sized companies, or divisions of larger companies, run their businesses. Dynamics accounts for approximately 2% of total revenue and is growing in the low double-digit area. The Dynamics revenue base is shifting from a perpetual license and maintenance model into a subscription model. As such, Dynamics has increased its profile and is slowly gaining share market share.

Microsoft’s presence in the P.C. market with both its O.S. and office productivity software allowed it to easily enter the server market. Today the I.T. backbone of many of the largest companies in the world is built on Microsoft server. Hence, replacing any part of the core of an enterprise’s I.T. environment would be a significant undertaking for any company in terms of cost, time, and risk. The early lead and substantial market share led to a wide variety of developers joining the ecosystem bringing in applications, middleware, and development tools.

In an IaaS model, the provider offers the hardware virtualization, networking, and storage as a computing service delivered over the internet. As software is added, IaaS quickly becomes PaaS. The provider also offers and hosts operating systems, middleware, and core I.T. applications. Currently, Microsoft Azure, Amazon AWS, and Google Compute are leaders in this category.

Microsoft has used its presence to attract more users to its user base, which in turn attracts more developers in a virtuous circle. Developers have a lot invested in learning certain languages and how to effectively write software under a given umbrella. It would be a time-consuming, and therefore costly endeavor to learn additional languages on a different platform. The GitHub acquisition (closed on October 26, 2018) bolsters Microsoft’s position for developers. Google, Apple, Amazon, and Microsoft each have a material presence on GitHub and use it for documentation of code. It remains to be seen if these mega-cap tech competitors will allow their developers to continue to use GitHub.