Uber ’s position in the autonomous vehicle race could equalize gross and net revenue, after no longer needing to pay drivers. Uber technologies have matched riders with drivers completing trips over billions of miles. At the end of 2019, Uber had 111 million users who used the firm’s ridesharing or food delivery services at least once a month.

Uber helps people get from point A to point B by taking ride requests and matching them with drivers available in the area. The firm refers to this as personal mobility, which also shorter - distance transportation via electronic bikes and scooters. Uber faces stiff competition from players such as Lyft (in the U.S.) and didi, a business in which uber has a 20 % holding after the sale of its operations in China to didi in 2016. while uber no longer operates in China, it does compete with didi in other regions around the world. The market remains fragmented, and uber competes with many local ridesharing platforms and taxis. Globally, the market is fragmented. Uber has a 30% global market share and will be the leader in the total addressable ridesharing market ( excluding China ) by 2024.

The firm ’s food delivery service will be one of the main revenue growth drivers for the firm as it will benefit from cross-selling to its large ridesharing user base. Further, utilize of uber ’s overall on-demand platform can also help the firm progress toward profitability. Uber has been in talks to acquire Grubhub in an all-stock deal for each Grubhub share. The addition of GrubHub could strengthen the supply and demand sides of uber ’s network effect moat source. On the supply side, the firm would be better able to attract and retain restaurants. With more food delivery requests, uber is likely to also maintain more of its ride-hailing drivers. Also, this may not only reduce diner acquisition costs for uber but will also allow uber to more effectively cross-sell its two main businesses to a larger user base.

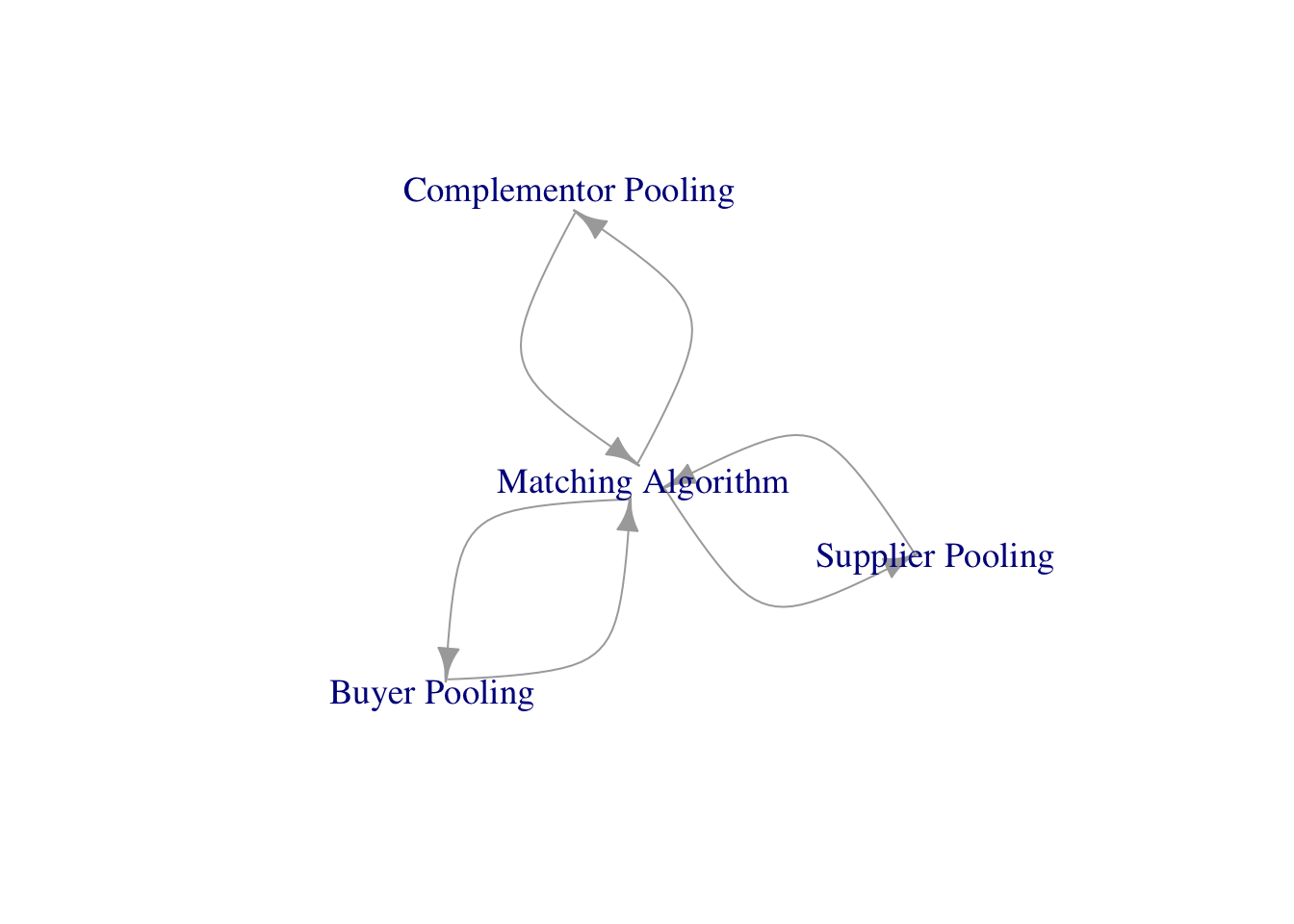

The ridesharing platform benefits from network effects and valuable intangible assets in the form of user data. These sustainable competitive advantages will help uber to become profitable and generate excess returns on invested capital. Uber ’s network effects benefit drivers and riders, creating a continuous virtuous cycle. As the number of drivers increased, the timeliness and reliability of the service improved. The riders on the platform benefit as more drivers are added, and existing drivers benefit from more riders, making the driver ’s use even more efficient. The increase in vehicle capacity usage is growing in the average number of rides dispatched per unique uber vehicle.

As uber benefits from its network effect, it gains access to valuable intangible assets in the form of user data, which helps the firm improve its services. In turn, Uber ‘s service may become more effective as it further monetizes real-time supply and demand-driven pricing. Uber may also use extensive data and knowledge to tap into other markets. Uber may use this data to tap into other markets. The firm may also increase its vehicles’ capacity usage. The firm compiles data from the rider app about the locations users request rides to and from and at what times of the day. When combined with the user-generated driver ratings, we think such information helps uber improve the timeliness of matching riders with drivers. Such overall enhancement in service could help the firm strengthen its network effect by increasing users and ride requests per user, which helps uber gather additional data.